Delve into the various factors that contribute to the high costs associated with property appraisals.

Challenges in data collection

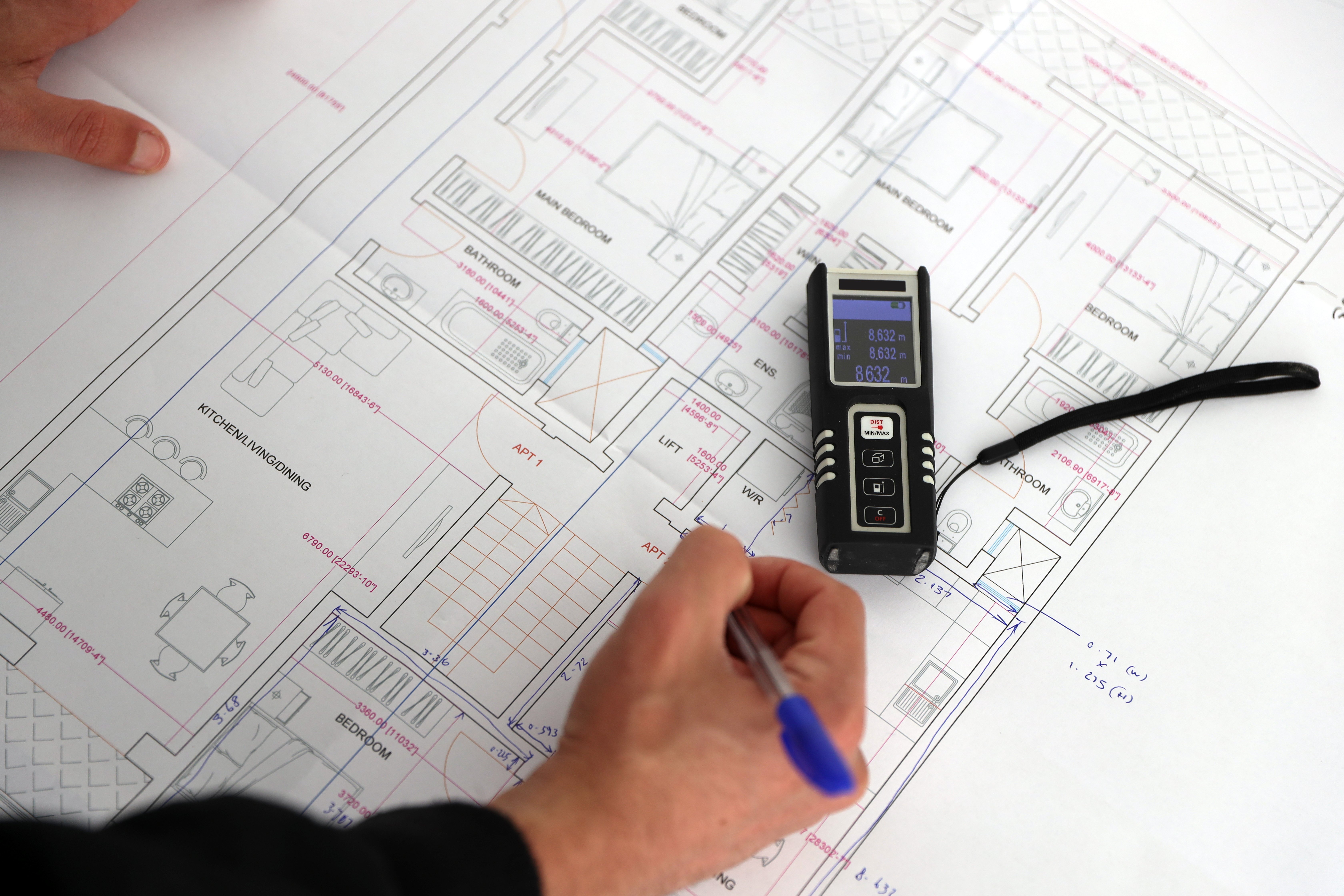

Property appraisals involve gathering a significant amount of data, which can be a time-consuming and challenging process. Appraisers need to collect information about the property's characteristics, such as its size, condition, and amenities. They also need to gather data on recent sales of similar properties in the area to determine its market value.

Data collection can be particularly difficult when dealing with unique or specialized properties that have limited comparable sales data available. Appraisers may need to rely on alternative sources of information or employ different valuation methods to estimate the property's value accurately.

Regulatory requirements and compliance

Property appraisals are subject to strict regulatory requirements and compliance standards. Appraisers need to adhere to guidelines set by regulatory bodies, such as the Appraisal Foundation and the Uniform Standards of Professional Appraisal Practice (USPAP). These standards ensure that appraisals are conducted in a consistent and unbiased manner.

Complying with these regulations often requires additional time and resources. Appraisers may need to conduct thorough research, provide detailed documentation, and follow specific procedures to meet the prescribed standards. The costs associated with maintaining compliance can contribute to the overall expense of the appraisal process.

Complexity of property valuation methods

Property valuation involves using various methods to determine the value of a property. Each method has its own complexities and requires specialized knowledge and expertise. Appraisers need to analyze factors such as the property's location, condition, income potential, and market trends to select the most appropriate valuation method.

Some common property valuation methods include the sales comparison approach, income capitalization approach, and cost approach. Each method requires collecting and analyzing different types of data, performing calculations, and making adjustments. The complexity of these methods can increase the time and effort required for an appraisal, contributing to higher costs.

Impact of location and property type

The location and type of property can significantly influence the cost of an appraisal. Properties located in remote areas or areas with limited comparable sales data may require additional research and analysis, leading to higher costs.

Similarly, unique or specialized properties, such as historical buildings or properties with complex features, may require appraisers with specialized knowledge and expertise. Appraisers with specific expertise may charge higher fees, especially if their services are in high demand.

In some cases, the size and complexity of the property can also impact the appraisal cost. Larger properties or properties with multiple buildings or units may require more extensive inspections and analysis, resulting in higher fees.

Role of appraiser experience and expertise

The experience and expertise of the appraiser can also contribute to the cost of an appraisal. Appraisers with more experience and specialized knowledge often command higher fees for their services.

Experienced appraisers have a deeper understanding of the local market, valuation methods, and regulations, which allows them to provide more accurate and reliable appraisals. Their expertise can be particularly valuable when dealing with complex properties or challenging market conditions.

While hiring an experienced appraiser may increase the upfront cost of the appraisal, it can help ensure the accuracy and reliability of the valuation, potentially saving the property owner from future financial risks.

TrendSource Property Condition Reports Help Lower Appraisal Costs

TrendSource Property Reports feed data into desktop appraisals to lower appraisal costs for financial institutions. A TrendSource field agent local to the appraisal site visits the location to get all required data, which is then provided to the financial institution.

By utilizing this information in desktop appraisals, financial institutions can significantly lower appraisal costs.