This past holiday season, TrendSource Trusted Insight conducted a two-part consumer insights research study to help retailers navigate the complexities of the holiday shopping experience and keep pace with today’s multi-device, omni-channel consumer. This study was conducted to provide retailers with useful insights that will help target marketing efforts and manage merchandising and display strategies in the upcoming year.

The first part of this study was conducted in October/November 2012 and analyzed shopping intentions and expectations leading up to the holidays. The second part, which was conducted in January 2013, utilized both data gathered from the pre-holiday results and from actual shopping outcomes during the holidays.

If you’d like to read the full report, the pre-holiday study can be found here, and the post-holiday study with comparison and analysis based on the pre-holiday study is available here. Or you can read through the main points from the holiday consumer insights study below!

1. Discounts matter

Pre-holiday results stated that over 50% of consumers would be hesitant to purchase without a discount. This statement rang true-- post-holiday results showed that 67 to 70% of all consumers bought more than half of their total purchases on sale items during the 2012 holiday season.

2. Mobile media is influencing in-store decisions

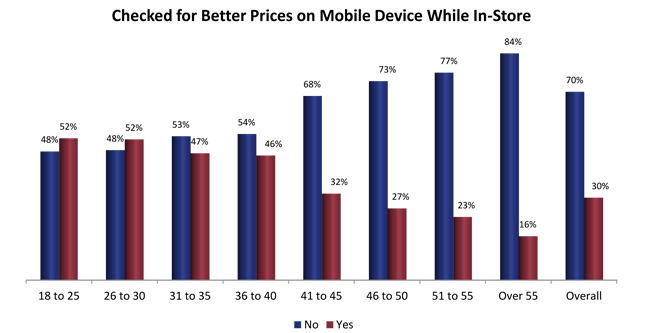

According to the post-holiday results, 29 to 32% of consumers checked for better prices on their mobile devices while in physical retail locations.

3. “Showrooming” is at a crossroads

With the rise of online shopping and mobile device research in stores, showrooming is becoming an increasingly challenging phenomenon for retailers to manage. Therefore, the importance of creating an engaging customer experience that is differentiated from the online buying experience is crucial.

4. Millennials – the swing demographic?

The survey results reveal that the frequency of checking for better prices while in-store was significantly more pervasive amongst millennials than older demographics. As the purchasing power of this cohort increases over the next decade, the concern of showrooming will only become more prevalent.

5. Fashion and apparel purchases trumped anticipated electronics purchases

Consumers purchased more holiday gifts in fashion and apparel and less in electronics than their initial stated intentions. Given that government fiscal decisions are still pending, these results are likely to resonate into early 2013, with budget-conscious consumers continuing to shop for fashion/apparel gifts over electronics.

Did you experience or observe any of these shopping trends this past holiday season? Did you find this consumer insights study helpful? Sound off in the comments section below.

About This Study

TrendSource conducted pre-holiday research by surveying North American Field Agents in The Source database between October 29th and November 9th, 2012. The results of the pre-holiday study represent 3,620 online respondents. The same survey methodology was used in post-holiday research between January 8th and 21st, 2013. The results of the post-holiday study represent 3,568 online respondents. All respondents opted in to respond voluntarily.