Thanksgiving is right around the corner, but those fall decorating ideas are getting pushed to the wayside in the blink of an eye as retailers prepare for the onslaught of holiday shoppers. The results of the 2015 Pre-Holiday Consumer Buying Intentions Study are in and full of insights for retailers!

Not So Shocking: Shoppers Go Digital

We’ve said it before and we’ll say it again: the rise of technology directly affects consumer buying behavior. We know, it’s no great revelation anymore.

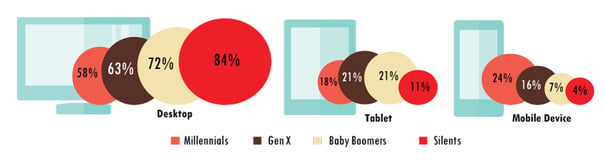

With so many digital device options to choose from, where are consumers turning to make their purchases? We found that 84% of Silents, 72% of Baby Boomers, 63% of Gen X’ers, and 58% of Millennials use a desktop to do their holiday shopping.*

Study results also found that the younger a consumer, the more likely he or she is to use a mobile device to shop. App usage is growing quickly, especially in the retail vertical, so we wanted to know how these consumers are using their mobile phones to shop and more specifically, what are they using them for? We found that 63% prefer a browser over an app. Of the 37% that do use a mobile app, 82% are using 3rd party apps like Amazon and Groupon and 18% are choosing to use a retailer app, like Kohl’s or Macy’s. When we asked what they are using apps for, the vast majority indicated discounts and coupons as their primary reason for using both 3rd party and retailer apps. But, when using a 3rd party app specifically, 10% are looking for a variety of the same product.

Path To Purchase In A Digital World

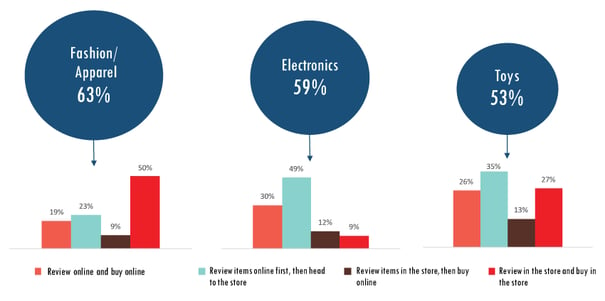

Year over year, the top 3 gift items on consumers’ lists have been Fashion/Apparel, Electronics, and Toys. Interestingly, the path to purchase within each of these categories is drastically different. When shopping for Fashion/Apparel items, the majority of shoppers (50%) review in the store and buy in the store, but when shopping for Electronics, the majority (49%) review items online first, then purchase in-store. When consumers are looking to purchase toys, many review online and purchase online (26%) without ever setting foot in a physical store.

Travel Be Damned, Holiday Shoppers Don’t Waver

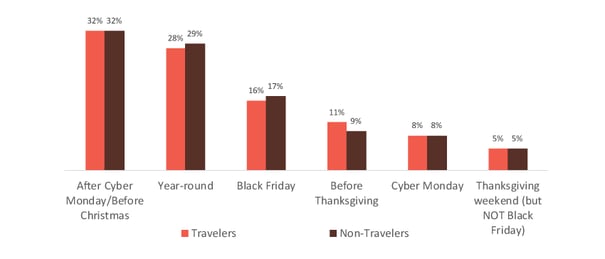

We asked over 4,000 consumers when they plan to shop this holiday season, and it looks like they may start before we’ve cleared the Thanksgiving dessert dishes. Holiday travel plans don’t seem to have any effect on consumer buying intentions either. 29% of consumers plan to travel around the holidays, but shopping is still taking place no matter where consumers are. Regardless of their holiday plans, many consumers still purchase their holiday gifts on Black Friday or on Thanksgiving weekend. But, the majority of holiday shoppers continue to shop year-round or after Cyber Monday/before Christmas for their gifts.

This just in: of those shoppers planning to purchase gifts on Black Friday, 38% plan to shop for themselves versus gifts for someone else. Consumers need to take advantage of those holiday deals any way they can, I guess.

Buying Intentions vs. Purchasing Outcomes

Regardless of consumers’ plans, we want to know their actual buying behaviors. Directly following the holidays, we’ll find out if consumers stuck with their buying intentions or if their purchasing plans went awry with the 2015 Post-Holiday Consumer Purchasing Report. Stay tuned!

*Generation age ranges: Millennials (19-34), Gen X (35-50), Baby Boomers (51-69), Silents (70+)