‘Tis the season for holiday consumer insights! With that in mind, the TrendSource team gathered around the fire, wearing our footed, one-piece pajamas for milk and cookies and, more importantly, the unveiling of the 2013 Pre-Holiday Buying Intentions Survey results. The results were more exciting than catching a glimpse of Santa! Ho, Ho, Ho and away we go! Let’s break it down.

Naughty: $ Nice: $$$

Many of us start out the season with the best of intentions to stay on budget. 66% of TrendSource’s survey respondents cited that they intend to spend about the same or a little more than they did last year, which is up from 60% in 2012. On the flip side, the intention to spend less saw a significant decline from 40% in 2012 to 34% for this season. Looks like more money will be spent on good holiday cheer this year!

On Donner and Blitzen!

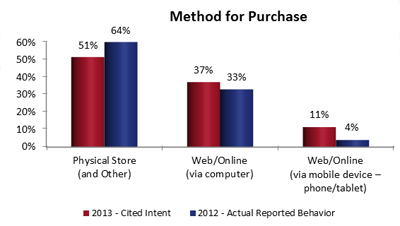

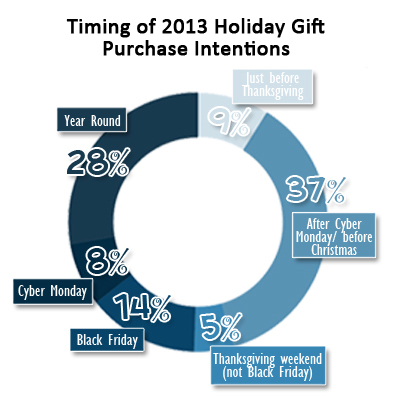

So much to do, so little time. More than half (51%) of our respondents have not started gift shopping, while 27% cited just starting. 22% are ahead of the game with a bit more than half done and no one is completely finished! Significantly more respondents will be shopping on Black Friday this year over last (14% vs. 11%) as well as Cyber Monday (8% vs. 2%). More respondents will be buying online this gift-giving season as well: 37% cited that they intend to shop online vs. 33% who reported doing so last year. Although the in-store experience is still leading the sleigh overall, fewer respondents intend to shop in-store than reported to do so last year (51% vs. 64%). Another statistic to note: consumers’ intent to shop via mobile device more than doubled from last years’ reported results (11% vs. 4%)!

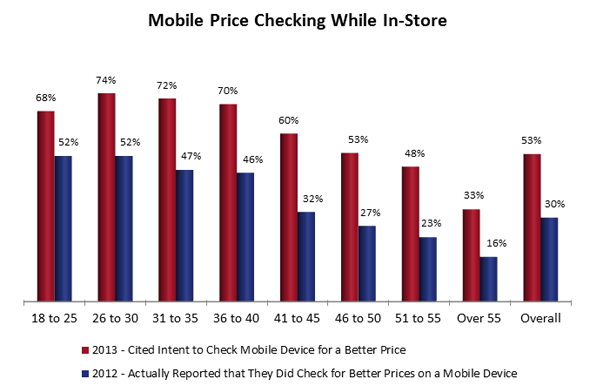

The Magic of the Holidays is for the Young? Not so Fast Sonny!

The mighty millenials may have paved the way, but it seems that you can teach old reindeer new tricks. Over twice as many 51-55 year olds (48% vs. 23%) and 55 and overs (33% vs. 16%) are jingle bell rockin’ their mobile device while in-store to check prices.

Although the older crowd may have learned a thing or two on their smartphone, they will still leave fighting the crowds on Black Friday to the young at heart. 28% of respondents between the ages of 18 and 25 will head out on that fateful Friday as will 19% of respondents 26 to 30 years of age. Wondering if this is a case of wisdom coming with age…

Help Wanted: Hiring Elves, Inquire Online

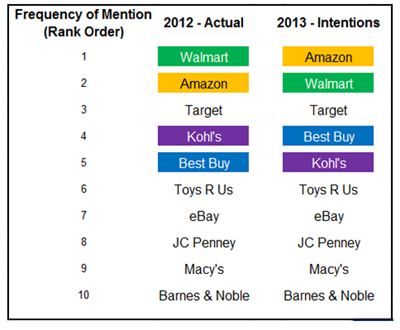

Online retailer, Amazon, is on top of the tree this year. Amazon slid into first postion over Walmart. Interestingly, Best Buy and Kohl’s swapped spots as well.

Is it a Red Ryder BB Gun?

What might Ralphy find under the tree this year? When asked if they had a specific top priority gift in mind this season, 31% of our respondents said they did and Xbox was the most coveted item.

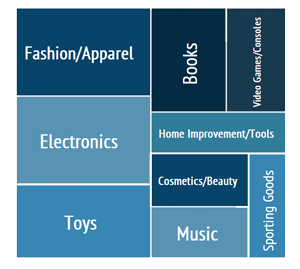

The top gift categories remain the same from last year, in order: fashion/apparel, electronics and toys. The most significant change was the increase in the electronics category and it being tied with fashion and apparel. 71% of respondents intend to buy fashion/apparel and 71% intend to purchase electronics. You need to look snappy will playing Xbox or surfing on your iPad.

But Wait There’s More...

There is more to learn than can possibly fit in this blog about the fascinating results of our survey. What’s the top cited path to purchase? What’s happening with social media for the holidays? For the full version of our 2013 Pre-Holiday Buying Intentions Study, click below.Don’t want the holidays to end? We don’t either! We will conduct another survey after all the gifts are put away to find out what actually happened in 2014. Stay tuned!

Methodology: TrendSource conducted this research study by surveying North American Field Agents in The Source database between October 22nd and November 10th, 2013. The results represent 3,706 online respondents who met the qualifying criteria of confirming intent to shop for gifts in the 2013 holiday season. All respondents opted in to participate voluntarily.