Like the first few hours of an infectious disease, these are some critical times for CVS Health, and they hope they have the right prescription.

Between keeping up with evolving retail (read: omnichannel) relationships and avoiding being flooded out by Amazon, the company has its work cut out for it and, wisely, they are already thinking outside the box.

Piloting a Prime-esque membership program while simultaneously completing an historic acquisition of health insurance giant Aetna, CVS Health is reconceptualizing its stores, pharmacies, and clinics in ways it hopes will keep it relevant in the years to come.

So, drop off your scripts and hope they’ve got generics as we examine the health care and retail market research to understand how CVS Health will be repositioning itself in the years to come in order to take on Amazon, reconsider the intersections of health care and retail in an increasingly digital world, and understand why they left all that cigarette revenue on the table back in 2014. And, yes, for those of you wondering, we will also be going full KKW and examine the receipts.

From Retail Health to Health Retail

Based in Rhode Island, CVS (Consumer Value Store) is the largest pharmacy chain in the United States in terms of location count and total revenue. And since Americans need their drugs like Kathy Lee needed Regis, that’s enough to put them at number seven in the Fortune 500 based on 2017 revenue. Their nearest competitor, Walgreens, sits at 19.

Of course, today’s competitors are not necessarily tomorrow’s, and CVS is looking not to the Rite Aids and Walgreens of the world, but to Amazon (at this point, who isn’t?!). Sure, CVS and Amazon’s 2017 revenues were roughly the same, but everybody knows who has a leg up in future markets.

I know You Care(Pass)!

When it comes to Amazon, it’s not ‘if you can’t beat ‘em, join them’—it’s ‘if you can’t beat them, join the party.’ That’s CVS’s thinking, as they are currently piloting their own version of subscription membership, the Care Pass.

For $5/month or $48/year, Care Pass members receive free prescription delivery (non members pay a $5 fee for each delivery), a 20% discount on all CVS Health branded products, and $10/month of in-store credit (which, or course, cannot be used for booze, lottery, prescriptions, or gift cards because that would be too much fun). Members also enjoy access to a 24/7 pharmacist hotline.

With these benefits, CVS aims to increase loyalty and create compelling reason to come into the store to purchase items that, these days, are all-too-easy to purchase online. Currently only offered in the greater Boston area, CVS is no doubt undertaking some serious retail market research, ironing out the kinks before their best shot at a Prime buster goes into primetime.

And, in news that these days seems so common it should just come automatically appended to any report, Amazon is about to enter the industry in a big way. They recently purchased PillPack, a startup online pharmacy.

With Amazon’s Amazonian market share and omnipresence in consumers’ daily lives, they look to be the nation’s premiere pill pushers by the time it’s all said and done. That’s why CVS’s needs are two-fold: to assert itself in the online prescription delivery market, and to create in-store experiences that can’t be ordered in an Amazon shopping cart.

Improving Corporate Health by Quitting Cigarettes

This, in a way, was the logic underpinning their famed 2014 decision to cease cigarette sales. Their branding needs to burn so hot that not even the biggest of rivers could extinguish it, they need to become synonymous with health. And that’s why they had to kick the butts in the butt.

It took the chain over a decade of dilly dallying before it finally quit its nicotine habit and, make no mistake about it, this move hurt. Hurt like losing $2 billion dollars after an 8% same-store sales drop.

Sure, it’s tempting to say that CVS cut a public relations cancer out of their system by excising the hypocrisy of simultaneously being a health company and one that sold cigarettes, but this ignores the guaranteed yearly sales those filthy little sticks provided. If cancer came with a couple billion dollar annual pay out, then the metaphor would be fair.

But, nonetheless, it had to be done and it is no coincidence that it happened just as CVS rebranded itself from CVS Caremark to CVS Health.

"By eliminating the sale of cigarettes and tobacco products in our stores, we can make a difference in the health of all Americans," CVS CEO Larry Merlo said at the time.

With their soon-to-be-consummated Aetna acquisition, the move makes even more sense and gives us some ideas about what CVS and the future of healthcare retail will look like.

A is for Aetna, Hopefully not Amazon

Heading into the merger, things seem to be going well. They just beat their third quarter earnings and revenue expectations, increasing revenue 2.4% to $47.3 billion, with an 8.4% rise in pharmacy revenue alone.

The acquisition, expected to be completed before the end of the month, will cost CVS about $69 billion.

With hospitals and insurers and hedge funds all being seduced by the sweet dulcet tones of Amazon and Alexa, it is important that CVS also assert its vision of the future intersections of pharmacy, healthcare, and retail.

First, they will reconceptualize their 1,100 existing clinics (branded MinuteClinics) and 10,000 stores as, to different extents, de facto wellness centers, through which they will look to manage chronic conditions without requiring members to regularly seek out more costly medical services.

These include diabetes, cardiovascular disease, hypertension, asthma, and behavioral health. By making their stores not just retail fronts and pharmacies but also active clinics will further blur the lines between health care and retail, reminding us all (as if we needed the reminder) that medicine is, at the end of the day, a business.

Using a spoke-and-hub system, their operations will be anchored by full service mothership health hubs, surrounded by satellite pharmacy stores.

The goal isn’t just to remain relevant in today’s rapidly changing retail world, it’s also to reduce hospital readmissions—remember, they are in the insurance business too, now. By combining Aetna’s clinical programs with CVS stores, they hope to be an outpatient clearinghouse where post-ops can follow up on their care without going to an actual medical office. They also hope to be a screening facility that can identify and manage chronic conditions without requiring repeated, regular trips to medical facilities.

But the really interesting part is what happens after they establish an Aetna rhythm. Because, eventually, they will need to push past the Aetna exclusive, eventually they will be looking to contract out these wellness centers to other insurance carriers.

They need to complete this reinvention (again, these are critical times) because the future looks a bit bleak. Beyond pharmacy, CVS relies upon a hodgepodge of retail categories that all seem vulnerable to an Amazonian invasion, namely: greeting cards, prefab (as in ‘not fresh’) foods and beverages, beauty and cosmetics, seasonal and holiday merch, and of course, that booming 21st century industry, photo development.

You NEED Prescriptions, They hope You WANT Make Up, But Spare Us the Receipts

CEO Larry Merlo understands that in-store differentiation is the name of the game, noting, “We're making the consumer experience, which will be an increasingly important competitive differentiator, and we are hard at work creating a plan to differentiate CVS Health in these patient journeys with the goal of making them simpler and more personalized while making care more accessible.”

And this isn’t just about health care. CVS would really like to up its beauty and cosmetics game, piloting the BeautyIRL program to see if elevating their offerings can draw a non-discount clientele to their makeup and skin care aisles.

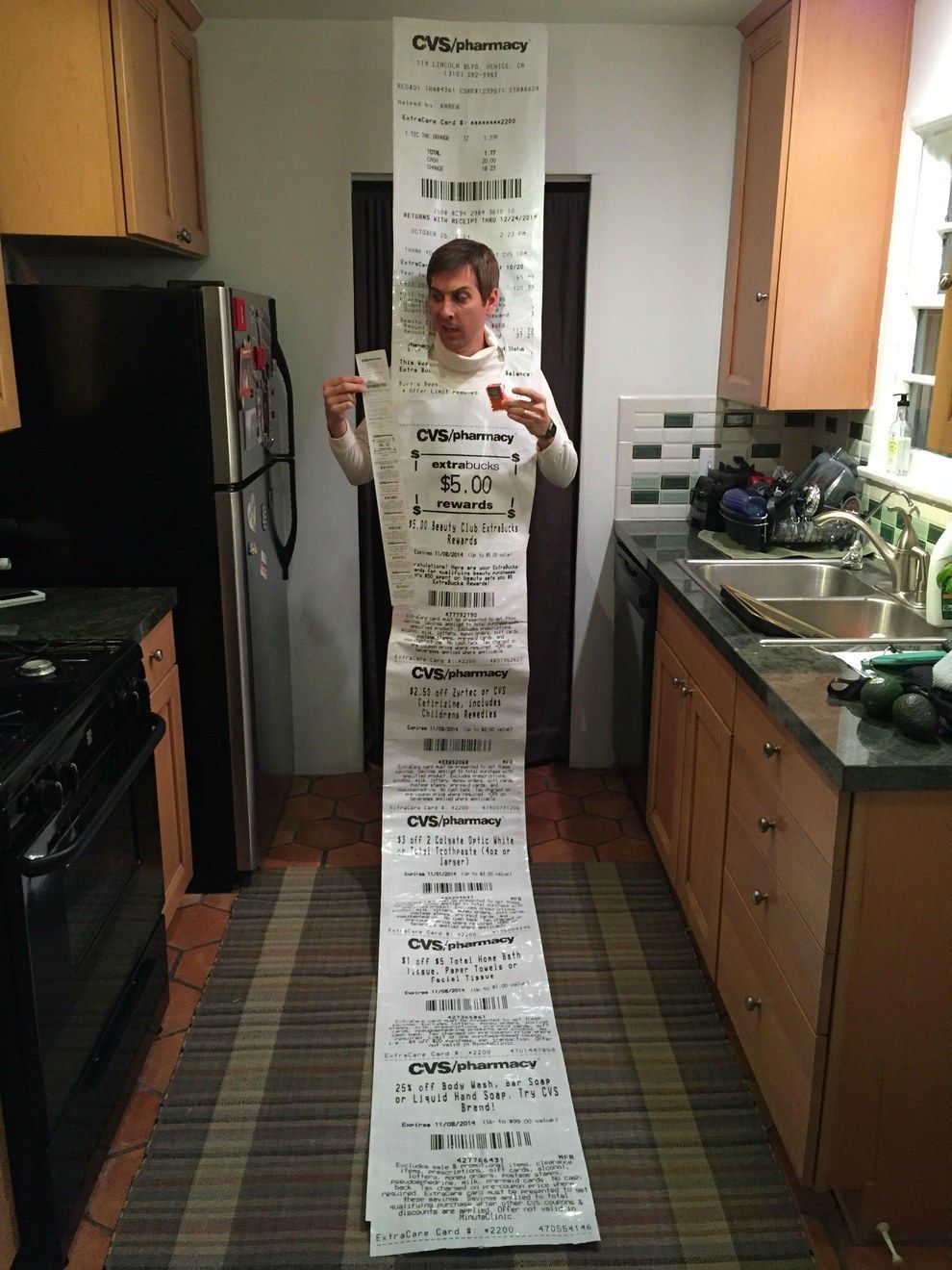

And, in a sign that they are catching up with the signs of the times, they recently began offering digital receipts in place of their famously, absurdly long paper receipts, which always seem to contain three coupons, one survey and an accounting of membership points.

Their receipts became a meme in its own right, with people repurposing them into sashes (Miss CVS Long Beach, 2018!) and unflatteringly comparing them to Meghan Markle’s 16-foot veil (“when you marry a CVS receipt”).

HealthCare Market Research Plus Retail Market Research Equals, Well, Nobody Knows Yet

It’s one thing to take careful aim and fire at a fixed target. That’s plenty difficult, requiring precision and patience, but what if that target is moving? Or, even worse, what if it is invisible?

That’s what the future of healthcare retail is like. Not just difficult to hit, but difficult to see. And, of course, that’s where retail and healthcare market research come in.

Signing on a strategic consultant to deploy multiple market research methodologies will help companies glimpse the future, to get a peek at the target they are trying to hit. Hopefully for CVS, that target is as big as their paper receipts.