You can buy a lot with $13 billion in cold cash. Islands…cities…elections…six to ten major market NBA teams. Or, if you are Amazon, you can acquire Whole Foods at a reported 27% premium over closing cost.

While the acquisition is nowhere near the biggest in business history, it is by far the largest in Amazon’s, and has led some to ask, why? Why would Amazon spend Zuckerberg money (ok, Bezos money) for a company with a decidedly niche customer base that feels out of reach for many Americans?

Most people are saying it’s millennials and, sure, they’ve got a little something to do with everything. But, no, this song is not about them. This acquisition has everything to do with penetrating local markets in grocery delivery, thereby increasing spend, and ultimately cornering the market. And our forthcoming Grocery Industry Study has the data to prove it.

In Online Grocery Delivery, Local Matters

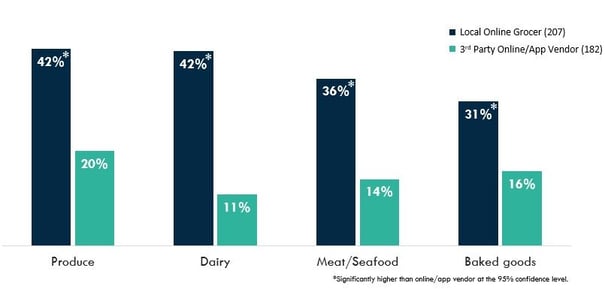

According to our market research study, people who order online grocery delivery from a local grocer are roughly twice as likely to order perishable goods as people who order their groceries from a third-party online vendor (read: Amazon). And in case you were wondering, it also tells us rather conclusively, that millennials are not disproportionately ordering groceries online.

But back to the main point: all things being equal, an online shopper buying from a local vendor is twice as likely to have branched past shelf-stable goods as one buying from Amazon. We surveyed shoppers who ordered groceries online within the last three months and this trend held across four discrete categories of perishable goods—produce, dairy, meat/seafood, and baked goods.

Up until now, most online grocery shoppers have shied away from ordering perishable goods, likely concerned by the distances food travels and its potential to spoil, and also perhaps placing a bit more faith in their familiar local grocer. That Amazon has acquired, seemingly overnight, a local toehold in markets across the country will help it overcome the perception that perishable items traverse untold delivery distances, coming from God knows where, traveling for God knows how long.

And $13 billion and some change will buy you one heck of a local footprint. With over 400 locations across the United States, Amazon is hacking away at yet another barrier between them and online dominance.

A Louboutin Footprint

There is more at play here. Whole Foods tend to be in affluent communities that can afford its premium prices, communities where “whole paycheck” is just an exasperated expression, not an unfortunate reality. This means that Amazon is getting its foot into 400+ very upscale front doors. And it is banking that the short distance between Whole Foods’ front door and their customers’ will convince shoppers that perishables will not perish en route. These are the customers Amazon wants to get onto their grocery delivery gravy train—those who value convenience over price (and can afford to), with many of them already Prime members.

Though it has a reputation for excessive cost and excess in general, Whole Foods also has a reputation for being the best-in-class when it comes to quality of produce, dairy, meat/seafood, and baked goods—perishables, all of them. So it’s not just that they are buying a local footprint, or even an affluent one, it’s also that they are buying one of the best brand names in fresh and perishable goods.

Sure, they’d like to get millennials on board—every ascendant generation is the apple of retail’s eye. But this move is primarily about bridging geographic gaps, not generational ones. Make a Venn diagram of Whole Foods customers and Amazon Prime members and you will see it too: Amazon is trying to convince its wealthiest customers to change how they buy their groceries, addressing their fears about safety, quality, and familiarity all in one fell swoop.

Our 2017 Grocery Industry Report cover these and other current trends and news in grocery. Download the report by clicking here.