...And we're back for part 2! Same rules as before--we're going to checkin on our market research blog, this time from a retail and CPG perspective, and see if our picks panned out or should just be panned.

Check out part 1 of Tanked it or Banked it.

So without further ado: Banked it or Tanked it: the Retail and CPG Edition.

Prediction: LaCroix Bubbling to the Top of Carbonated Beverages – April, 2016

What We Said Then: Sparkling Water is having a moment—a big, bubbly, effervescent moment. With no calories, artificial flavors, and or sweeteners, sparkling water in general—and millennial favorite LaCroix in particular—are stepping right into a health-conscious trend and are primed for imitation and success.

Banked it or Tanked it: Banked it—not to be hipster about this, but we were sooooo into LaCroix before you were. New competitors emerge seemingly every day, but as Fortune recently noted, “While other sparkling water companies [have] customers, LaCroix has fans.” With their all-or-nothing social media campaigns, their pop art cans that just so happen to be tailor-made to pop out on Instagram, and sodas continuing their downward plummet, we couldn’t have said it better. They have fans. We may be some of them.

Outlook: Sales for sparkling water are already up 13% in 2017, and could spike as high as twenty by years’ end, and the bubbles played a huge role in water’s ascension to the number one bottled beverage in the United States.

So, for sparkling water in general, the outlook is great, but things may get a bit crowded for LaCroix. Coke recently purchased Topo Chico, a Mexican sparkling water already popular in Mexico and in the US borderlands, for $22 million and plan to immediately expand its market, pushing it as a higher end competitor to legacy brands like Perrier. This ads to their existing sparkling portfolio which includes sparkling versions of the Dasani and Smart Water brands.

There is one lingering question that might ultimately pop this bubble, however: the continued implication that carbonated water is ultimately bad for you (or as the fear mongering New York Post has it “really, really not good for you,” which to our minds is a really, really big exaggeration. From where we sit, anything that gets people to drink more water is actually prettay prettay prettay good).

Prediction: FDA Labels Sugar A Problem – June, 2016

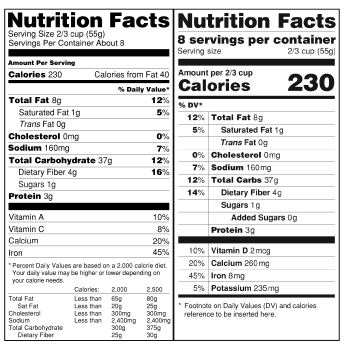

What We Said Then: Food manufacturers are scrambling to reformulate and relabel their products in preparation for June, 2018, when the FDA will require additional information on food labels, including “added sugar”, and will also dramatically change serving sizes to more accurately reflect contemporary dietary habits (read: we eat a lot).

Banked it or Tanked it: Tanked it, with an assist from the new president.

Almost immediately after taking office, the new administration indefinitely extended the compliance window and just last month announced a new set of deadlines: January 2020 for companies with more than $10 million in food sales, and January 2021 for those below that mark. The FDA stresses that only the timing is changing, explaining, "The framework for the extension will be guided by the desire to give industry more time and decrease costs, balanced with the importance of minimizing the transition period during which consumers will see both the old and the new versions of the label in the marketplace."

Outlook: As far as we know, these changes are still coming, just 18-36 months after we initially expected. Of course, trying to predict the current administration’s forthcoming policy is, well, difficult. So, stay tuned on this one.

Prediction: Better the Second Time Around? Online Resale Market Surges – May, 2016

What We Said Then: Owing to millennials’ environmental and economic concerns, online second-hand fashion sales are surging, with different resellers targeting specific markets and niches, as the industry expands form nascent upstart to full blown phenomenon, and ultimately a normalized part of retail.

Banked it or Tanked it: Yeah, we banked this one too. Online second-hand fashion continues to thrive, pulling $18 billion in sales last year, growing 11% per year, and poised to reach $33 billion in 2021. More interestingly, it is becoming a leisurely experience: peak shopping time is from 9:00pm-10:00pm (primary second-screening time), 63% of shoppers admit to drinking while online resale shopping, and 85% prefer shopping on their couch to in the mall. As brick-and-mortar retailers struggle with how to make fashion shopping fun and relevant for today’s and tomorrow’s consumer, it seems that online secondhand retail already has.

Outlook: So, will we all just be wearing each other’s clothes? If so, who will be the dominant broker? Well, Amazon lacks the infrastructure to compete in this space and probably won’t even try. That leaves the departments stores, the boutiques, and the discounters.

With its appeal primarily aimed at fashion conscious consumers seeking deep discounts (premium denim averages an 80% savings through second hand channels, for example), one would assume this was the province of the impoverished. But this is not the case—this isn’t people looking for 50% off a $20 Old Navy blouse. The profile of the second hand online shopper is getting more and more affluent: According to ThredUp, 77% of their most active shoppers are professionals, 71% own their own home, and 73% are live near an urban center.

Hear that, Nordstrom? That’s chin music.

Prediction: Chips on the Table: Lawsuits Highlight EMV Liability Transfer Problems – June, 2016

What We Said Then: The rollout of the new EMV card chip has not gone great, with retailers and customers outraged by increase wait times, and merchants and payment system operators scrambling improve the anti-fraud system before it’s too late.

Banked it or Tanked it: We’re giving ourselves a 50-50 on this one. Yeah, the cards continue to be problematic—we’ve been noticing increased wait times among our grocery and retail clients, for sure—but we aren’t taking credit for pointing out that a really complicated problem would need a really complicated solution.

Along those lines, Mastercard is unveiling a faster platform called M/Chip, though it is still too early to tell how this will speed up the process.

Outlook: Fraud is moving increasingly to digital spaces—in ideal conditions in which the merchant has a compliant terminal, fraud is down. But among non-compliant merchants, and especially within the meteoric rise of CNP (card not present) fraud, it seems that we aren’t mitigating fraud, just migrating it.

But, let’s not get weighted down with today: Let us briefly entertain ourselves by thinking of tomorrow’s fraud. Consider that 40% of European and Canadian, and 85% of Australian transactions, are contact-less payments—waving a card or phone in front of a terminal, like ApplePay or GoogleWallet. Perhaps card companies, payment managers, and retailers should be thinking about how to keep tomorrow fraud free rather than patching up a sinking ship.

Prediction: Slimy Yet Satisfying: Insect Protein Bars Taking Flight – June, 2016

What We Said Then: As the planet’s population grows, its resources are increasingly taxed, and people will need to find a sustainable, cost-effective source of protein to replace large scale industrial agriculture. Fitting these criteria, and already consumed by many cultures the world over, insects are a prime candidate but manufactures must get past the “ick” factor to achieve widescale adoption.

Banked it or Tanked it: Banked it. Shortly after publication, a new player on the block emerged, Flying SpArk, and their formula seems to be the most promising yet. Replacing the first wave of insect protein providers (crickets, grasshoppers, and mealworms) with fruit flies helps to get people over the ick factor for a host of reasons. Also, it doesn’t hurt that Ikea is backing them.

Outlook: For the time being, the insect-based protein market is predominately, if not entirely, online. Until mainstream taste catches up with manufacturer enthusiasm, it will stay this way. Sure, there are popup kitchens that will do a monthly insect-based meal, but the days of rolling into your favorite fast food joint and ordering a fruit fly special, let’s just say those days are far off.

See what else we've tanked or banked along the way by checking out our most recent 2017 Retail Industry Report.