PHASE 1

Client Objectives

A supermarket chain came to TrendSource with a specific request — to confirm or dispel the customer perception that their prices were more expensive than the competition. Armed with the most accurate information from a competitive pricing program, the client planned to evaluate their marketing strategy and reposition themselves as needed.

PHASE 2

Discovery

Using TrendSource’s QUEST methodology to understand and address the strategic priorities of the client, TrendSource uncovered additional opportunities for the client to consider that would return the most actionable insights. The client would undoubtedly benefit from instituting the following:

• Customer insights research to understand their customers and their expectations

• A competitive study to determine their market position and benchmark the customer experience in their stores vs. the competition

PHASE 3

Program Development

Based on deeper understanding of their needs and objectives, TrendSource recommended the following approach:

• A customer intercept program to understand current customers and evaluate their expectations

• A competitive study to benchmark against the competition

PHASE 4

Keys to Successful Implementation

1. Each month, TrendSource visited key competitors as defined by the client and audited their pricing on a list of core items.

2. Once yearly, TrendSource obtained customer perceptions of market competitiveness on a variety of factors (e.g., service, pricing, shop-ability) through a three-week customer intercepts (exit survey) study.

PHASE 5

Analysis and Results

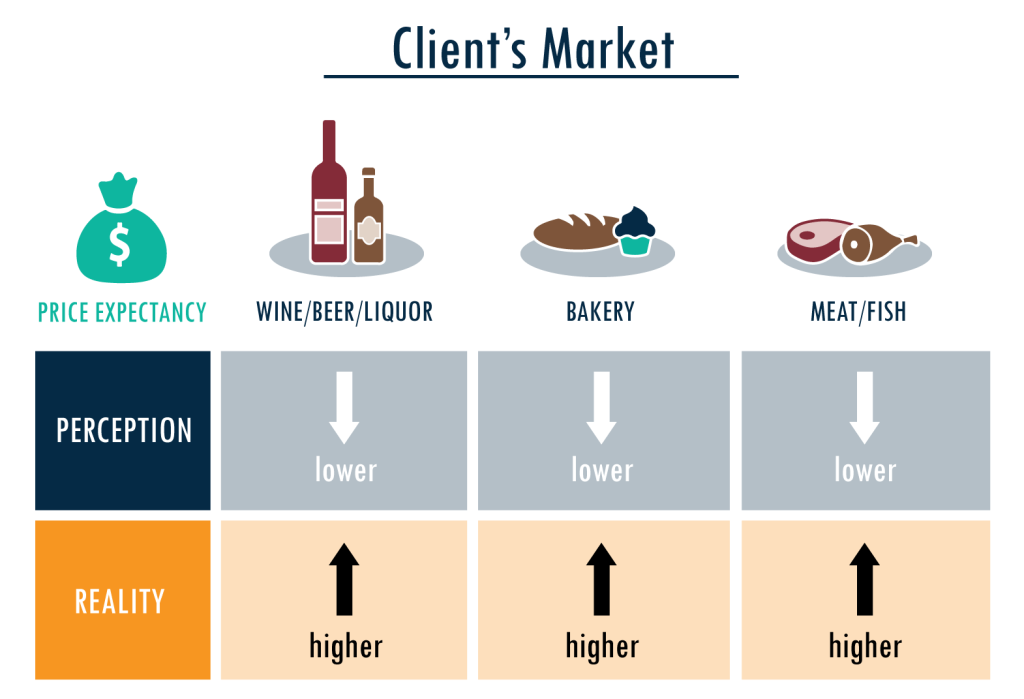

Customer perception data from intercept surveys was analyzed in conjunction with competitive data collected via price audits. Results revealed that from the consumer’s point-of-view, relative price was consistent across all categories. Practically, this meant that if a consumer viewed Chain A as more expensive in the dairy category, they were more likely to perceive them as more expensive in meat and fish, produce, and bread as well.

Further research revealed:

• Freshness, quality, and value, respectively, were the most important factors to client customers overall

• Better prices and variety were the top two offerings that other grocery stores provided that client’s stores did not.

The direct comparison of customer perceptions vs. reality allowed the client to see that their customers are often incorrect in their perception of the client’s price position. Beyond that, TrendSource was able to provide a detailed breakdown of customer perceptions vs. actual prices by competitor, region, and category, enabling targeted marketing communication.

The unique program also showed competitor pricing strategies were much too complex for consumers to understand. A comprehensive understanding of perceived and actual prices allowed TrendSource to identify areas where consumer price perception did not match actual price position. This highlighted areas of opportunity for the client’s marketing and business development teams as well as proven areas of client success.